Japanese real estate is polarized! Tokyo: After 26 years, house prices have reached a new high with an average price of 50,000+

Cctv newsAccording to the latest data released by the Japan Institute of Real Estate Economics in September, the sales volume of new residential buildings in the Japanese metropolitan area increased by 7% year-on-year in August, achieving growth for two consecutive months. Among them, the sales volume of real estate in downtown Tokyo once increased by 40%.

uptown

This is a residential area in the center of Tokyo. This 100-family house is nearing completion. According to the developer, the first phase has been sold out.

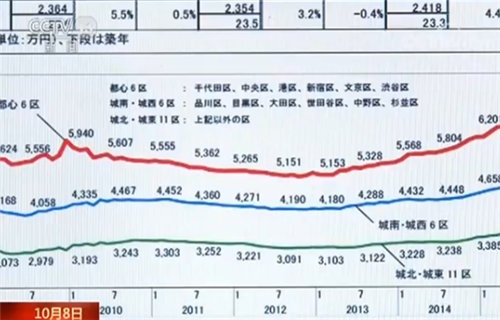

Since the Bank of Japan implemented the monetary easing policy four years ago, the price of new residential buildings in the Japanese capital circle has continued to rise. In the first half of this year, the average price of each set hit a new high in 26 years after Japan’s real estate bubble burst in the 1990s. At present, the average price of three bedrooms and one living room of about 70 square meters is about 65.62 million yen, or about 3.88 million yuan.

According to the developer, as the main force of buying a house, most dual-employee parenting families prefer houses with complete facilities near the station. For the convenience of their old age, wealthy elderly couples have a strong demand for changing houses in the downtown area with convenient transportation.

It is estimated that the annual sales volume of new residential buildings in the capital circle is expected to increase by 6.2% year-on-year this year, reaching 38,000 sets.

The property market in the capital circle is hot, but in many local cities in Japan, there is a surplus of houses and housing prices are shrinking. The land price trends announced by Japan’s Ministry of Land, Infrastructure, Transport and Tourism this month show that the three metropolitan areas of Tokyo, Osaka and Nagoya remain unchanged, while other local cities have fallen by 1%.